The Olympic Games have long been a symbol of global unity, athletic excellence, and cultural celebration. Since their ancient inception in Greece, the Games have evolved into a massive international event, showcasing the pinnacle of human physical achievement and fostering a spirit of friendly competition. As we look forward to Paris 2024, the anticipation and…

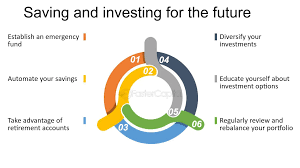

Expert Saving and Investing Tips: A Comprehensive Guide to Secure Financial Future.

In an era where financial security is increasingly important, saving and investing wisely have become paramount. Whether you’re just starting on your financial journey or looking to optimize your existing strategies, understanding the fundamentals of saving and investing is crucial. This guide aims to provide expert tips and insights to help you navigate the complexities of financial management and achieve your long-term goals.

Importance of Saving and Investing

Saving and investing go hand in hand to build wealth and secure your financial future. While saving involves setting aside a portion of your income for future use, investing entails putting your money to work to generate returns over time. Both are essential components of financial planning, offering various benefits, such as:

- Financial Security: Building a robust savings fund and making prudent investments can provide a safety net during emergencies or unexpected expenses.

- Wealth Accumulation: By consistently saving and investing, you can grow your wealth over time, allowing you to achieve major financial goals such as buying a home, funding your children’s education, or retiring comfortably.

- Beating Inflation: Investing in assets that outpace inflation helps preserve the purchasing power of your money, ensuring that your savings retain their value over the long term.

- Passive Income Generation: Certain investment vehicles, such as dividend-paying stocks or rental properties, can generate passive income streams, supplementing your primary source of earnings.

Tips for Effective Saving

- Set Clear Goals: Establish specific short-term and long-term financial goals to guide your saving efforts. Whether it’s building an emergency fund, buying a house, or funding your retirement, having clear objectives will help you stay motivated and focused.

- Create a Budget: Track your income and expenses meticulously to identify areas where you can cut costs and save more. Utilize budgeting apps or spreadsheets to monitor your cash flow and allocate funds towards savings regularly.

- Automate Your Savings: Take advantage of automatic transfer features offered by banks to divert a portion of your income directly into your savings account. This “set it and forget it” approach ensures consistent saving without the temptation to spend.

- Embrace Frugality: Practice mindful spending by distinguishing between wants and needs. Cut unnecessary expenses, such as dining out frequently or impulse purchases, and prioritize spending on essentials and experiences that align with your values.

- Utilize Tax-Advantaged Accounts: Maximize the benefits of retirement accounts like 401(k)s, IRAs, or their equivalents in your country. Contributions to these accounts are often tax-deductible or grow tax-deferred, accelerating your savings growth.

- Build an Emergency Fund: Aim to accumulate 3-6 months’ worth of living expenses in a readily accessible savings account to cover unforeseen financial setbacks like medical emergencies or job loss without resorting to debt.

Strategies for Smart Investing

- Educate Yourself: Take the time to learn about different investment options, risk factors, and strategies. Familiarize yourself with fundamental financial concepts such as asset allocation, diversification, and risk tolerance to make informed decisions.

- Diversify Your Portfolio: Spread your investments across various asset classes, such as stocks, bonds, real estate, and alternative investments, to minimize risk and optimize returns. Diversification helps cushion your portfolio against volatility in any single market or sector.

- Invest for the Long Term: Adopt a patient and disciplined approach to investing, focusing on the long-term growth potential of your assets rather than short-term fluctuations. Avoid succumbing to market speculation or attempting to time the market, as it often leads to suboptimal outcomes.

- Monitor and Rebalance Regularly: Periodically review your investment portfolio to ensure it remains aligned with your financial goals and risk tolerance. Rebalance your holdings as needed to maintain your desired asset allocation and mitigate excessive risk exposure.

- Seek Professional Advice: Consider consulting with a qualified financial advisor or investment professional, especially if you’re unsure about complex investment decisions or need personalized guidance tailored to your unique circumstances.

- Stay Emotionally Resilient: Remain calm and rational during market downturns or periods of volatility. Avoid making impulsive decisions based on fear or greed, as emotional reactions can derail your investment strategy and harm long-term performance.

Advanced Strategies for Maximizing Returns

- Tax-Loss Harvesting: Utilize tax-loss harvesting techniques to offset capital gains with capital losses, thereby reducing your tax liability. This strategy involves selling investments that have incurred losses and reinvesting the proceeds in similar but not identical assets to maintain market exposure.

- Asset Location Optimization: Optimize the placement of your investments across taxable and tax-advantaged accounts to minimize taxes and maximize after-tax returns. Allocate tax-efficient investments like index funds or municipal bonds to taxable accounts and tax-inefficient assets like actively managed funds to retirement accounts.

- Employ Dollar-Cost Averaging: Implement a dollar-cost averaging strategy by regularly investing a fixed amount of money at predetermined intervals, regardless of market fluctuations. This approach helps smooth out market volatility and potentially lower your average cost per share over time.

- Consider Alternative Investments: Explore alternative investment opportunities such as peer-to-peer lending, real estate crowdfunding, or private equity, which offer diversification benefits and potentially higher returns compared to traditional assets.

- Factor-Based Investing: Consider incorporating factor-based or smart beta strategies into your investment approach, focusing on specific factors such as value, momentum, or low volatility to enhance returns and manage risk more effectively.

- Environmental, Social, and Governance (ESG) Investing: Align your investment portfolio with your values by integrating environmental, social, and governance criteria into your investment selection process. ESG investing allows you to support companies that prioritize sustainability, ethical business practices, and social responsibility.

Saving Tips

- Set Clear Goals: Determine what you’re saving for, whether it’s a vacation, a new car, or an emergency fund. Having clear goals can help you stay motivated and focused on your saving efforts.

- Create a Budget: Track your income and expenses to identify areas where you can cut back and save more. Budgeting tools and apps can help streamline this process and keep you on track.

- Automate Your Savings: Set up automatic transfers from your checking account to your savings account each month. This “pay yourself first” approach ensures that you’re consistently setting aside money for savings before spending it elsewhere.

- Take Advantage of Employer Benefits: If your employer offers a retirement savings plan, such as a 401(k) or a pension plan, take full advantage of it. Contribute enough to qualify for any employer matching contributions, as this is essentially free money.

- Shop Around for Higher Interest Rates: Compare interest rates offered by different banks for savings accounts and CDs. Look for accounts with competitive rates to maximize your earnings on your savings.

- Minimize Fees: Be mindful of any fees associated with your savings accounts or other financial products. Look for accounts with low or no fees to avoid eating into your savings.

- Emergency Fund: Aim to build an emergency fund with enough money to cover three to six months’ worth of living expenses. This fund can provide a financial safety net in case of unexpected expenses or job loss.

Investing Tips

- Educate Yourself: Take the time to educate yourself about different investment options, risk factors, and investment strategies. There are numerous resources available, including books, online courses, and financial websites.

- Start Early: The power of compounding means that the earlier you start investing, the more time your money has to grow. Even small contributions made consistently over time can add up significantly thanks to compounding returns.

- Diversify Your Portfolio: Spread your investments across different asset classes, industries, and geographic regions to reduce risk. Diversification can help mitigate the impact of volatility in any one investment.

- Invest Regularly: Make investing a habit by setting up automatic contributions to your investment accounts. Investing a fixed amount regularly, such as monthly or quarterly, can help smooth out market fluctuations and build wealth over time.

- Stay Calm During Market Fluctuations: Market volatility is a normal part of investing, but it can be unsettling for many investors. Resist the urge to make impulsive decisions based on short-term market movements. Instead, focus on your long-term investment strategy and stay disciplined.

- Rebalance Your Portfolio: Regularly review your investment portfolio to ensure it remains aligned with your financial goals and risk tolerance. Rebalance your portfolio as needed by buying or selling assets to maintain the desired asset allocation.

- Consider Tax Implications: Be mindful of the tax implications of your investment decisions. For example, investing in tax-advantaged accounts such as IRAs or 401(k)s can help minimize your tax liability and maximize your investment returns.

- Seek Professional Advice: If you’re unsure about how to invest or need personalized guidance, consider seeking advice from a qualified financial advisor. A professional advisor can help you develop a customized investment plan based on your goals, risk tolerance, and time horizon.

Saving and investing are indispensable pillars of financial success, empowering individuals to achieve their goals and build wealth over time. By following these expert tips and strategies, you can cultivate healthy saving habits, construct a well-diversified investment portfolio, and navigate the complexities of the financial markets with confidence. Remember, financial planning is a journey, and consistent effort, discipline, and patience are key to realizing your aspirations and securing a prosperous future.

Good article and straight to the point. I don’t know if this is actually the best place to ask but do

you guys have any ideea where to get some professional writers?

Thanks in advance 🙂 Escape rooms