Best Ways to Invest in the S&P 500

The S&P 500, a benchmark of the top 500 publicly traded companies in the U.S., is a staple in the investment world. With its rich history of strong returns, many see it as a core component of a balanced portfolio. But how do you start investing in this financial powerhouse? Let’s explore the best strategies for S&P 500 investments and set you on the path to financial growth.

Table of Contents

Understanding the S&P 500

History and Significance of the S&P 500

The S&P 500, established in 1957, is more than just a stock market index—it’s a snapshot of the American economy. Tracking 500 large-cap companies, it provides a comprehensive overview of market health. Its consistent inclusion of giants like Apple, Microsoft, and Amazon makes it a critical measure for investors and policymakers alike.

What Makes the S&P 500 a Reliable Investment?

The S&P 500 isn’t just about size; it’s about performance. By representing approximately 80% of the total U.S. stock market value, it reflects the broader economy. Companies included in the S&P 500 undergo strict financial evaluations, ensuring only the best performers are part of the index.

Key Sectors Represented in the S&P 500

From technology and healthcare to energy and consumer goods, the S&P 500 captures a diverse array of industries. This diversity shields investors from sector-specific risks, providing a more stable investment option.

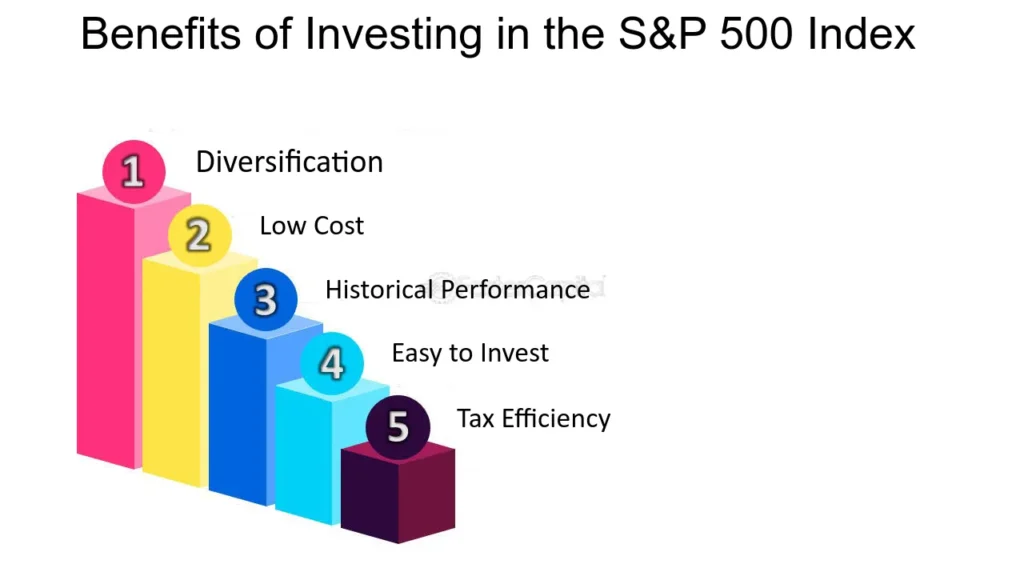

Advantages of Investing in the S&P 500

Diversification Benefits

Investing in the S&P 500 gives you exposure to a variety of sectors, reducing the risk tied to a single industry. With tech, healthcare, and finance leading the charge, it’s a one-stop shop for diversification.

Strong Historical Performance

The historically delivered an average annual return of about 10%. While past performance doesn’t guarantee future results, it offers a reassuring track record for long-term investors.

Low-Cost Investing Options

Through index funds and ETFs, you can invest in the S&P 500 with minimal fees. These low-cost options make it accessible even for beginners, ensuring you keep more of your returns.

Passive Income Potential Through Dividends

Many companies in the S&P 500 pay regular dividends, offering investors a steady income stream.

Different Ways to Invest in the S&P 500

Investing in S&P 500 Index Funds

Index funds are mutual funds designed to mirror the performance of the S&P 500. With low expense ratios and no need for active management, they’re a favorite among passive investors. Vanguard and Fidelity are leaders in this space, offering highly-rated index funds with competitive fees.

Investing in S&P 500 ETFs (Exchange-Traded Funds)

ETFs, like index funds, track the S&P 500 but trade like individual stocks. They combine the best of both worlds—diversification and flexibility. Popular options include SPDR S&P 500 ETF Trust (SPY) and iShares Core S&P 500 ETF (IVV).

How to Start Investing in the S&P 500

Setting Financial Goals

Before diving in, define your investment objectives. Are you saving for retirement, a major purchase, or simply aiming to grow your wealth? Knowing your goals will guide your choice of investment vehicles.

Choosing the Right Investment Platform

From traditional brokerages to modern robo-advisors, selecting the right platform is crucial. Look for low fees, intuitive interfaces, and robust research tools to simplify your investment journey.

Creating an Investment Plan

Once you’ve selected a platform, decide on your approach. Will you invest a lump sum or dollar-cost average into the market? A clear plan can help you stay disciplined and avoid emotional decisions.

Risks of Investing in the S&P 500

Investing in the S&P 500 comes with numerous benefits, but it’s not without risks. Understanding these risks helps you manage your portfolio wisely and prepare for potential challenges.

Market Volatility

The stock market is inherently volatile, and no exception. Prices can fluctuate wildly due to macroeconomic factors, geopolitical events, or company-specific news. While the index generally trends upward over the long term, short-term swings can test even seasoned investors’ patience.

Economic Downturns

During recessions or economic crises, the S&P 500 tends to lose value as consumer spending decreases and companies face lower profits. For instance, during the 2008 financial crisis, the index plummeted by nearly 40%. Staying invested through such downturns requires a long-term perspective.

Sector-Specific Risks

Certain sectors within the S&P 500, such as technology or energy, may underperform due to regulatory changes, market saturation, or shifts in consumer behavior. Diversification within the index helps mitigate this, but it cannot eliminate sector-specific risks entirely.

Risk Management Tips

- Diversify Beyond the S&P 500: While the index offers broad exposure, including international stocks, bonds, or commodities can further reduce your portfolio’s risk.

- Maintain an Emergency Fund: Avoid investing money you might need in the short term. An emergency fund ensures that market downturns don’t force you to sell at a loss.

- Rebalance Your Portfolio: Periodically adjust your investments to maintain your target asset allocation, especially if certain sectors outperform others.

Long-Term vs. Short-Term Investment Strategies

Benefits of Long-Term Investing in the S&P 500

The S&P 500 rewards patience. By holding your investments for years or even decades, you can benefit from compound growth and ride out market downturns. Historically, long-term investors in the index have achieved positive returns despite short-term market crashes.

Short-Term Trading Opportunities

For active traders, the S&P 500 offers ample opportunities to profit from short-term price movements. Using ETFs or options, traders can capitalize on daily fluctuations. However, this approach requires expertise, constant monitoring, and a high tolerance for risk.

Balancing Short-Term and Long-Term Goals

Investors can adopt a hybrid approach by allocating a portion of their portfolio to long-term index funds and another to short-term speculative trades. This strategy balances stability with the potential for higher returns.

Tax Implications of S&P 500 Investments

Taxes can significantly impact your investment returns. Knowing the tax rules around S&P 500 investments helps you maximize your profits.

Tax Benefits of Index Funds and ETFs

Index funds and ETFs are tax-efficient because they generate fewer capital gains distributions compared to actively managed funds. This means you pay less in taxes during the holding period.

Capital Gains Taxes

When you sell an S&P 500 investment for a profit, you’re subject to capital gains tax. The rate depends on how long you held the investment:

- Short-term (less than a year): Taxed as ordinary income.

- Long-term (more than a year): Taxed at a lower rate, typically 15% or 20%, depending on your income.

Tax-Efficient Strategies

- Hold for the Long Term: Long-term capital gains rates are lower than short-term rates.

- Use Tax-Advantaged Accounts: Invest in the S&P 500 through retirement accounts like a 401(k) or IRA to defer or eliminate taxes on earnings.

- Harvest Tax Losses: Offset gains by selling underperforming investments at a loss.

Tools and Resources for Investing in the S&P 500

Equipping yourself with the right tools and resources can make your investment journey smoother and more informed.

Best Platforms and Apps for S&P 500 Investments

- Brokerages: Fidelity, Vanguard, and Charles Schwab offer user-friendly platforms with low fees and excellent research tools.

- Robo-Advisors: Platforms like Betterment and Wealthfront automate the investment process, making them ideal for beginners.

- Mobile Apps: Robinhood, Webull, and M1 Finance provide easy access to trading with minimal costs.

Research Tools and Financial News Resources

- Use platforms like Morningstar or Yahoo Finance to analyze fund performance and market trends.

- Follow reputable financial news outlets like Bloomberg, CNBC, or The Wall Street Journal for timely updates.

Educational Materials for Beginners

- Explore online courses from Coursera or Khan Academy to understand the basics of investing.

- Read books like The Intelligent Investor by Benjamin Graham for timeless investment advice.

Common Mistakes to Avoid

Even experienced investors make mistakes. Avoiding common pitfalls can improve your chances of success with S&P 500 investments.

Emotional Investing

Reacting emotionally to market fluctuations often leads to poor decisions. Stick to your investment plan instead of selling during dips or chasing gains during surges.

Over-Diversification or Under-Diversification

On the other hand, putting all your money in a few S&P 500 stocks can expose you to unnecessary risks. Balance is key.

Ignoring Fees and Expenses

Choose low-cost index funds or ETFs and minimize transaction costs wherever possible.

Neglecting to Rebalance Portfolios

As certain sectors within the S&P 500 outperform others, your portfolio may become unbalanced. Regular rebalancing ensures you maintain your desired asset allocation.

Real-Life Examples of S&P 500 Success Stories

The S&P 500’s track record is filled with success stories, offering inspiration and insights for investors.

Stories of Consistent Growth Over Decades

Take Warren Buffett’s Berkshire Hathaway, which has consistently outperformed the S&P 500 by adhering to long-term investment principles. Similarly, investors who held the S&P 500 during the 2008 crisis saw remarkable growth over the next decade.

Lessons from Famous S&P 500 Investors

Investors like Peter Lynch and John Bogle emphasize the importance of simplicity and patience. Their focus on low-cost index investing and long-term growth remains relevant today.

Learning from Past Market Recoveries

After every downturn, the S&P 500 has historically bounced back stronger. From the dot-com bubble to the COVID-19 crash, the index has demonstrated resilience, rewarding those who stayed invested.

Future Outlook for the S&P 500

The future of the S&P 500 remains promising, driven by innovation and economic growth.

Predicted Trends and Growth

Experts predict continued growth in sectors like technology, healthcare, and renewable energy. The increasing adoption of artificial intelligence and green technologies is likely to drive new opportunities.

Influence of Technology and Innovation

Tech giants like Apple, Microsoft, and Nvidia continue to dominate the index, fueling its upward trajectory. These companies lead the way in shaping the future of industries worldwide.

Global Economic Factors Impacting the Index

While the S&P 500 is a U.S.-centric index, global factors like inflation, interest rates, and geopolitical stability play significant roles. Staying informed about these trends is crucial for investors.

Conclusion

Investing in the S&P 500 is one of the best ways to build wealth over time. Whether you choose index funds, ETFs, or mutual funds, the S&P 500 offers a diversified and historically reliable path to financial growth. Remember to stay informed, manage risks, and maintain a long-term perspective to maximize your returns.

FAQs

- What is the minimum amount needed to invest in the S&P 500?

Many brokerages allow you to start investing in S&P 500 ETFs or index funds with as little as $1. - Are S&P 500 investments safe during economic downturns?

While the S&P 500 may decline during downturns, long-term investors typically recover losses and achieve growth over time. - How often should I review my S&P 500 investments?

Reviewing your portfolio semi-annually or annually is sufficient for most investors. - Can international investors invest in the S&P 500?

Yes, many international investors can access S&P 500 ETFs through global brokerages. - Which is better: S&P 500 ETFs or index funds?

It depends on your preferences. ETFs offer more flexibility, while index funds are better suited for automatic, long-term investments.